Related Fresh Findings

Mastercard: India stops payment service provider from issuing cards

The Reserve Bank of India has accused the company of violating data storage laws. The bank said Mastercard had not complied with rules requiring foreign card networks to store data on Indian payments exclusively in India. There has been no response from the global payments service provider. Mastercard will be prohibited from issuing debit, credit or prepaid cards to customers in India from 22 July. The Reserve Bank's decision will not have any impact on Mastercard's existing customers.

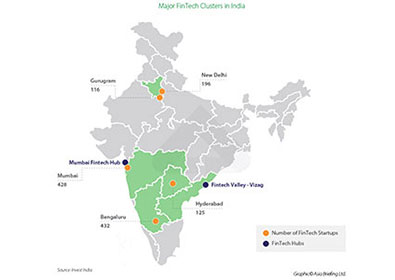

India’s Fintech Market: Growth Outlook and Investment Opportunities

India’s fintech market is the world’s fastest growing – 67 percent of the more than 2,100 fintech entities in operation have been set up in the last five years. Bengaluru and Mumbai are where most fintech companies have their India headquartered – as they are the country’s technology and financial hubs. Last year, 33 new fintech investment deals worth US$647.5 million were closed in the Indian market in the quarter ending June 2020, compared to China’s US$284.9 million.

Booking Holdings’ New Fintech Unit Aims to Help Travelers Beat Banks at Their Own Game

Bookings Holdings Fintech boss Daniel Marovitz says payments is arguably the world's largest industry. Across the online travel universe, look for payments to eventually become a line item — and very material to companies' financials.

Fintech Is Thriving And Becoming Mainstream

Fintech is the term that is used to describe financial technology. Financial technology is any type of tech that is used to aid financial services, whether they are targeted towards other businesses or to the consumers themselves. These financial services are performed via software and other technology and can cover anything from app payments on your phone to cryptocurrency.

What is FinTech? “Democratization of financial services” and ”Technology Supremacy”

The protagonist of FinTech, which subdivides the functions provided by current financial institutions and uses technology to automate, realizes low-cost and high efficiency, is a new venture. On the other hand, financial services that were limited to serving the affluent class in the past have also moved towards democratization.

Fintech Payment Trends in 2021: Six Experts Weigh In

In 2020 the fintech industry witnessed ground-breaking changes and achieved goals that could have taken years. While the pandemic might be subsiding, the Fintech industry isn’t showing any signs of slowing down. The pandemic has changed the way people interact with financial services, thereby accelerating the adoption of innovative digital financial solutions.

From the archive

Leave a Comment